If you plan to work in Australia, you have two options: be employed by a company, or be self-employed. If you are self-employed, you will need to apply for an Australian Business Number (ABN), which is quite a simple process. Here we explain what an ABN is, and how to get one.

Table of Contents

What is an ABN and what is it used for?

An ABN (Australian Business Number) is a unique identification number assigned to businesses and freelancers in Australia. It is used to identify companies during commercial transactions and to facilitate tax administration. If you intend to engage in self-employed activity in Australia, you must apply for an ABN from the Australian administration. The ABN is a unique 11-digit number that identifies your business or organisation to the Australian government. This number also allows your customers to identify you as a supplier in order to pay you for the goods or services you sell to them. It is also an essential number for any correspondence with the Australian tax authorities.

Note that an ABN is necessary in addition to a TFN for those who want to work as independent contractors.

Start your freelance activity

To determine if your activity is an activity requiring the creation of an ABN, it must have the following characteristics:

- It must be commercial, you must sell products or services

- You must intend to make a profit from this activity – unlike a hobby

- The activity must be repeated regularly and be organised in a professional manner

- You must have the relevant knowledge or skills.

In other words, you can apply for an ABN to work as a consultant, web designer, graphic designer, gardener, cleaner, driver, teacher, etc. when you have several clients to whom you sell your services.

It is important to note that if you are self-employed or running a business in Australia, you need an ABN to be in good standing with Australian tax requirements. Without an ABN, you could be subject to higher withholding taxes and tax penalties.

Employee or self-employed?

On the other hand, if a company offers to hire you for a given job but asks you to obtain an ABN, beware!

It is illegal for a company to treat its employees as sole traders. Companies that do this illegally reduce their labour costs. Indeed, by doing so, they are not paying the taxes and superannuation for you. In addition, you do not have the same rights as an employee.

Keep in mind that although it is easy to obtain an ABN, an employer does not have the right to ask you to obtain one as a condition of employment.

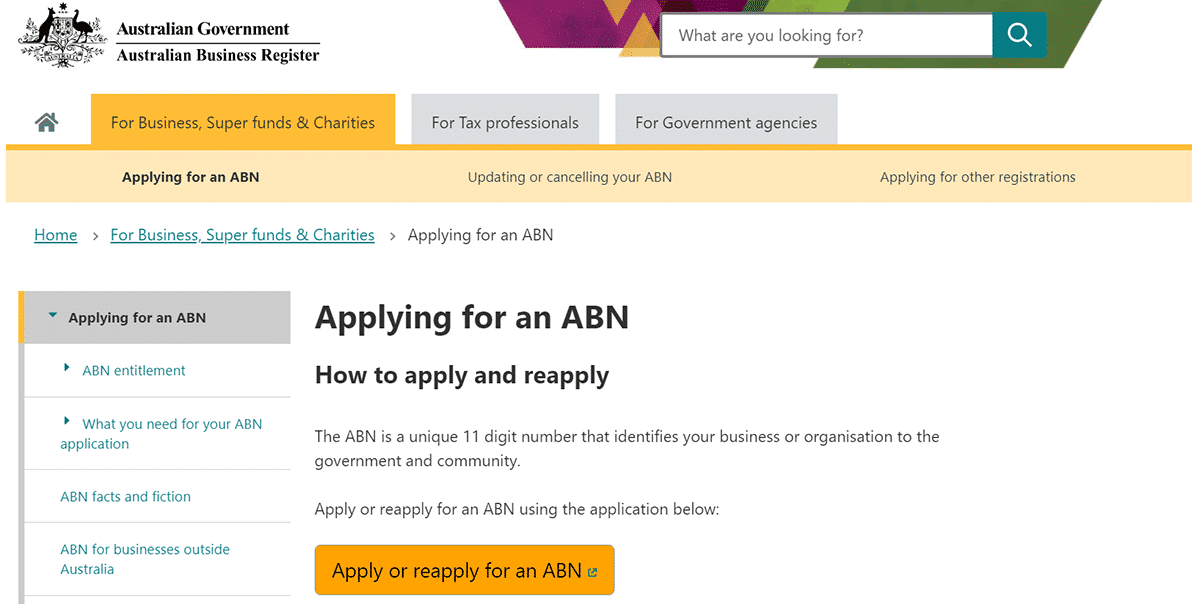

How to get an ABN?

The ABN application is done online and is completely free. It is done via the Australian government website:

You will need to complete a series of questions to make sure your activity is eligible for an ABN. If it is, you will get your ABN straight away. A digital document will be issued to you, and you will receive a hard copy within 28 days. To complete your application, you will need to provide:

- The nature of your main self-employed activity

- The structure of your company (generally “individual sole trader” if it is just you involved in the business, “partnership” if there is more than one person)

- Your Tax File number (TFN)

- Your contact details (postal address, email, phone number).

How to update or cancel your ABN?

You are responsible for updating your ABN contact details. You will need to do this within 28 days of any change in circumstances. Likewise, if your business structure changes, you may need to cancel your ABN and request a new one. If your business has been sold or has gone out of business, you will need to cancel your ABN.

The fastest way to update your information or cancel your ABN is online using the myGovID app.

Tax obligations with an ABN

Declare your income at the end of the financial year

When you are an employee, taxes are deducted directly from your pay. At the end of the Australian financial year, all you have to do is report on the ATO website the amount paid by your employer.

When working under an ABN, you must pay your taxes yourself at the end of the tax year. If you worked both as an employee and self-employed (with your ABN) during the tax year (from July 1 to June 30), you will have to declare all your income in the same tax declaration, at same time.

As a self-employed person, you will be paid a gross amount by your client and it is then your responsibility to pay your taxes. It is important to put money aside to pay your taxes at the end of the fiscal year.

For this you need:

- Estimate your annual income

- Define your tax status and the tax bracket in which you fall

- Calculate your tax amount

Tax statuses and rates (2023 – 2024)

Depending on your situation, different tax rates are possible:

Tax rates for residents

You will be considered a tax resident as soon as you have your main residence or live more than 6 months per year in the country at the same address.

| Taxable Salary Class | Tax rate |

|---|---|

| 0 – $18,200 | 0 |

| $18,201 – $45,000 | 19 cents for each $1 over $18,200 |

| $45,001 – $120,000 | $5,092 plus 32.5 cents for each $1 over $45,000 |

| $120,001 – $180,000 | $29,467 plus 37 cents for each $1 over $120,000 |

| $180,001 and over | $51,667 plus 45 cents for each $1 over $180,000 |

Non-resident tax rates

If you do not work enough in Australia to be considered a tax resident, the tax rate on your Australian salary will be higher.

| Taxable Salary Class | Tax rate |

|---|---|

| 0 – $120,000 | 32.5 cents for each $1 |

| $120,001 – $180,000 | $39,000 plus 37 cents for each $1 over $120,000 |

| $180,001 and over | $61,200 plus 45 cents for each $1 over $180,000 |

Working Holiday Visa holder rates

These rates apply to working holiday maker income regardless of residency for tax purposes. You are a working holiday maker if you have a visa subclass 417 (Working Holiday) & 462 (Work and Holiday).

| Taxable Salary Class | Tax rate |

|---|---|

| 0 – $45,000 | 15% |

| $45,001 – $120,000 | $6,750 plus 32.5 cents for each $1 over $45,000 |

| $120,001 – $180,000 | $31,125 plus 37 cents for each $1 over $120,000 |

| $180,001 and over | $53,325 plus 45 cents for each $1 over $180,000 |

Example: You have a WHV and estimate that you can earn $1,000 per week thanks to your activity under ABN.

- If you earn $1,000 gross per week, your annual income will be approximately $52,000 ($1,000 x 52 weeks).

- You are on a Working Holiday Visa, so you will be taxed at 15% on $45,000 and 32.5% on the remaining $7,000, i.e.: $6,750 (15% 45,000) + $2,275 (32.5% 7,000) = $9,025.

- Weekly, that’s $175 in taxes that will have to be set aside. Take it that your net weekly salary is $825.

💡 Backpacker advice: If you plan to stay in Australia for a while, consider putting some money aside for your retirement. Open a superannuation account to deposit money into.

Declare the GST

The GST (Goods and Services Tax) corresponds to VAT in other countries. In Australia, the GST is 10%. As a self-employed person, you will only have to pay GST if your income under ABN is greater than $75,000 per year. If you estimate that you will earn less than $75,000 with your ABN, you do not need to register for GST.

You will be able to register for GST once your ABN has been created. Once registered, you will need to include GST in the price you charge your customers. You will also be able to request reimbursement of the GST on the products or services that you buy for your business.

For more information: GST in Australia: How it works

What jobs can I do under an ABN?

Whether it’s a full-time job or just an income supplement, working under an ABN has many advantages and is attracting more and more people. Most often, being self-employed means choosing your own schedules, working at your own pace, working remotely…Many people only see benefits in being a sole trader.

From those looking to start their own small business, to those working in services, to those drawn to the digital nomad life…Having an ABN is an easy way to get started on your own. Some of the most common jobs that use an ABN include:

- cleaning (for individuals or professionals)

- delivery people (Ubereats, Deliveroo…)

- personal consultants or coaches

- graphic design (webdesign, photographer, editor, etc.)

- work on construction sites (ploughing) such as carpenters, plumbers etc.

- home assistance, baby sitters, sports coaches.

Become freelance in Australia

All the regulations for working as a freelancer in Australia. With the best sites, salaries, invoicing, taxes and more.

How to Issue Invoices Under an ABN?

To issue invoices under an ABN in Australia, follow these steps:

- Create an invoice: Use billing software or create an invoice template. The invoice should include:

- Your name or your business name and your ABN.

- The client’s contact details.

- A detailed description of the goods or services provided.

- The total price to be paid (including GST (Goods and Services Tax) if applicable).

- The invoice date and payment terms.

- Include GST if necessary (for incomes over $75,000/year): If you are registered for GST, you must include GST in your invoices. This means an additional 10% on the total amount. Ensure that it is clearly indicated that GST is included.

- Number your invoices: Each invoice should have a unique number to facilitate tracking and management.

- Send the invoice: Provide the invoice to your client via email, mail, or another agreed-upon method.

- Keep records: Keep a copy of all invoices for your accounting and for GST reporting.

- Track payments: Ensure to follow up on received payments and remind clients of late payments.”

This is a basic structure for generating compliant invoices within Australia, incorporating the necessary details for both GST-registered and non-registered businesses.

What is the difference between TFN and ABN?

The TFN (Tax File Number) and ABN (Australian Business Number) are both identification numbers used in Australia, but they have different functions.

The TFN is your Tax File Number. This 9-digit number is unique to each individual and is required to be able to work in Australia. With each new job, you will have to provide it to your employer. It is the Australian Taxation Office (ATO) that issues your TFN. The application is free and can be done online, on the official website. The TFN is used for tax filing, income tax calculation and tax refund

The ABN (Australian Business Number) stands for Australian Business Number. It is essential if you want to start a business in Australia. It is indeed the unique identification number that will distinguish your company once created. The ABN is issued by the Australian Business Register. If you want to be self-employed, you must have a TFN and an ABN.

In summary, the TFN is used to identify individuals to the Australian tax authorities for tax reporting and tax calculation, while the ABN is used to identify businesses to the tax authorities and for business transactions. It is possible to have an ABN without having a TFN if you are not working in Australia, but for a company.

FAQs ABN Australia

Any business conducting commercial activities in Australia, whether for profit or not, must have an ABN. The same applies to individuals wishing to work as freelancers in Australia.

To obtain an ABN, you must register online with the Australian Business Register (ABR) and provide information about your business. The application is done online.

Yes, applying for an ABN is free and done online.

Getting an ABN may take up to 28 business days, but most applications are processed more quickly.

No, there are certain conditions that your business/you must meet to be eligible for an ABN.”

Hey guys,

a little different question. I received my ABN in June 2017 and earned money for like three months or so. I left Australia in September 2017 and since then didnt earn any money. But I didn´t cancel my ABN. Is this going to be problem or does the australian government cancel my ABN by themselves at one point? I hope you can help me out with that question. Thanks in advance,

Robin

Hi Robin,

The tax office gives you three years to have no income with your ABN, then they’ll suspend it for inactivity.

hey there,

I am currently in the same situation but it’s almost impossible for me to cancel my ABN from overseas after having left Australia permanently. I wonder – did your ABN really get suspended for inactivity after 3 years or is it still logged as ‘active’ in the ABN register?

Cheers, Janina

Hi Janina, yes it’s supposed to marked as suspended after a while. Cheers

I earned 4 months worth of wages on an ABN back in 2020 but had to leave Australia due to covid and I never lodged a tax form. I’m due to come back to Australia in October on a tourist visa, will I get stopped at the border for this?

Thanks

Hi Jack,

You don’t need to lodge a tax return or a non-lodgment advice if both of the following apply:

– All of your income was earned as salary or wages while you were a WHM.

– The total of your taxable income for the income year was less than

$37,001 for 2019–20 and earlier income years

$45,001 for 2020–21 and later income years.

Cheers

Hello to our Guide,

is that true and does it still apply for the tax year 2022/23?

I am still unsure about the matter because on the ATO website it says if you have an active ABN that you got income with you have to file a tax return no matter what..

Thank you very much in advance for your help.

Cheers, Janina

Hi Janina, yes you need to do your tax return and include incomes earned with your TFN (as an employee) and your ABN (as a freelance). Cheers

Hello Jack,

I wonder – did you get stopped at the border for not having lodged a tax return back in 2020?

Did someone mention it or did you get in trouble because of it – like having to pay a fine etc.? Oh and were you eben able to obtain the tourist visa in the first place?

I can’t help but be curious.

Thanks in advance,

Janina

Hi Janina, no it shouldnt be an issue – see extract from official website:

You don’t need to lodge a tax return or a non-lodgment advice if both of the following apply:

All of your income was earned as salary or wages while you were a WHM.

The total of your taxable income for the income year was less than

$37,001 for 2019–20 and earlier income years

$45,001 for 2020–21 and later income years.

Hi, I’m coming to Australia on WHV subclass 417 with the intention of applying for ABN and work on my own from my laptop. Is there any 6-month work limitation for ABN holders on WHV?

Hi Matt,

No all good 🙂 Enjoy !

Hi I am on a 417 visa and have to do my three months regional work for second year visa.

Is it true I have to be on tax file for them three months in order to receive pay slips? (I’m currently on abn) if not then what documents must I produce when applying for second year visa?

Thanks

Hi Shane, you must have your TFN too as you needed it to create your ABN. Cheers

Hi

I have a company in the Uk and wish to trade in australia also online and have physical staff

Can I apply on this basis from the Uk ?

Thanks in advance

Hi Andrew, You wont be able to apply for an ABN, you will need to be in Australia. But you can trade in Australia with your UK company. Cheers

Hello,

My boss wants me to get the ABN but after the job here I’m gonna leave Australia so I will only get my money from one person. Is it a bogus-self employment if I do so? And if yes what can happen?

And if i destroy something at work do I liable for the damage?

Thank you

Hi there, if it is only for this job, you should negotiate for your boss you employ you as an employee and not a contractor! Cheers

If the foreign company has applied for ABN three months ago …. Yet didn’t get ABN, what may be the process to raise invoice & can I get the payment? What what shall be the and tax implication??

Hi there,

You should contact the ATO for this – 3 months is way too long. You usually get your ABN straight away or within 28 days. Contact them to follow up your application. Cheers

Want to understand…. any other information needed?

Hey see my other response. Cheers