To work in Australia, you will need to get your Tax File Number (TFN). Your TFN must be communicated to your employer when you start a new job. So here is all the information you need about TFN in Australia, what it is, how to get it, deadlines etc.

Table of Contents

What is a TFN? What is it for?

Your TFN is a unique and personal 9-digit number. This number allows you to be registered with the Australian Tax Office (ATO). It is essential if you want to work in Australia (regardless of your visa).

It is important to get your TFN before you start working in Australia. The TFN application is a mandatory step if you plan to work in Australia. If you do not complete this step, you will be taxed at the maximum rate (47%). But don’t worry, when you start a job, you still have 28 days to provide your Tax File Number to your employer.

This number does not change and is assigned to you for life (regardless of whether you change your name, visa, address etc). You can therefore return to Australia with a second working holiday visa or another visa and use the same number.

Your TFN is a confidential number, and you should only share it with trusted organisations.

How to Apply for a TFN in Australia?

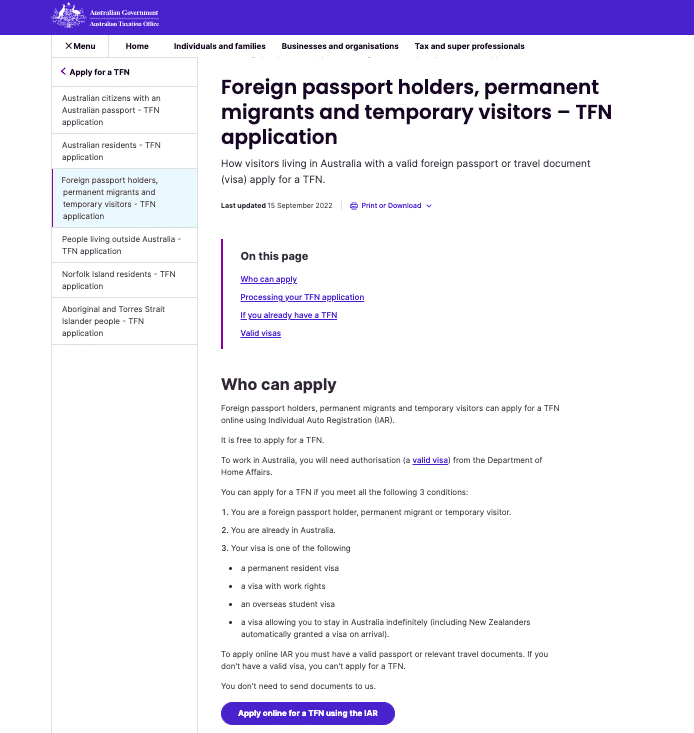

A Tax File Number (TFN) is essential if you plan to work in Australia. Applying for one is free and must be done from within Australia—you cannot apply before arriving.

To get your TFN you need to apply online using Individual Auto Registration on the Australian Tax Office website.

Step 1: Check Your Eligibility

To apply for a TFN, you must:

✅ Hold a foreign passport (or be a permanent migrant or temporary visitor)

✅ Be physically in Australia

✅ Have a valid visa that allows you to work (e.g., Working Holiday Visa, Student Visa, Permanent Resident Visa)

Step 2: Gather Your Documents

Before starting your application, make sure you have:

📌 Your passport

📌 An Australian postal address (where your TFN will be sent)

📌 An Australian mobile number

📌 A valid email address.

Apply for a TFN: online application process

Visit the Australian Taxation Office (ATO) website

Note that if the website is under maintenance you can always download the TFN application form (it will be available for download) and send it to the address indicated on the form. Websites do not stay long under maintenance, so we recommend you wait a few hours and re-try.

Once on the homepage, click on “Apply online for a TFN“:

Fill out the Online Form

Information

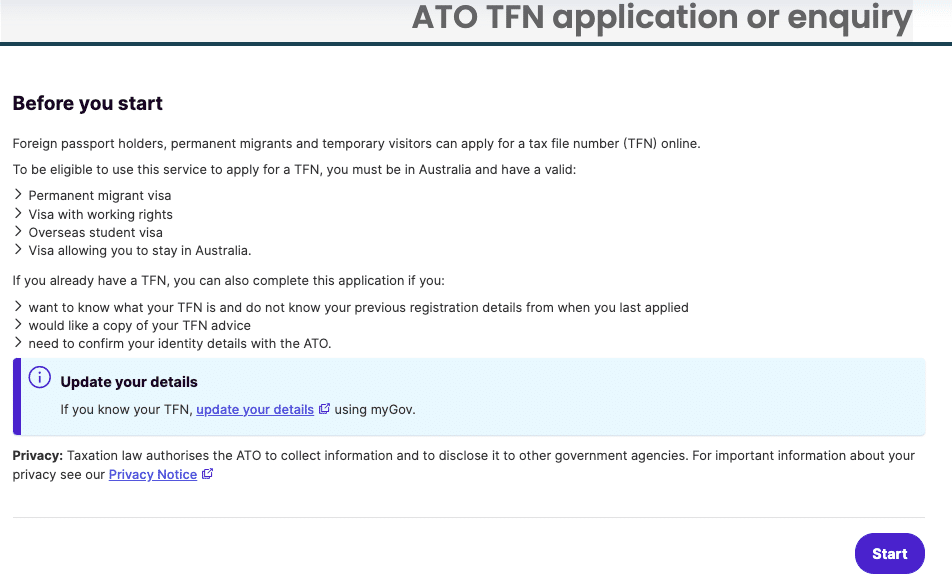

The first page explains who can apply for a tax file number, and provides you the useful phone numbers if you wish to contact the ATO. After reading the page, click Start.

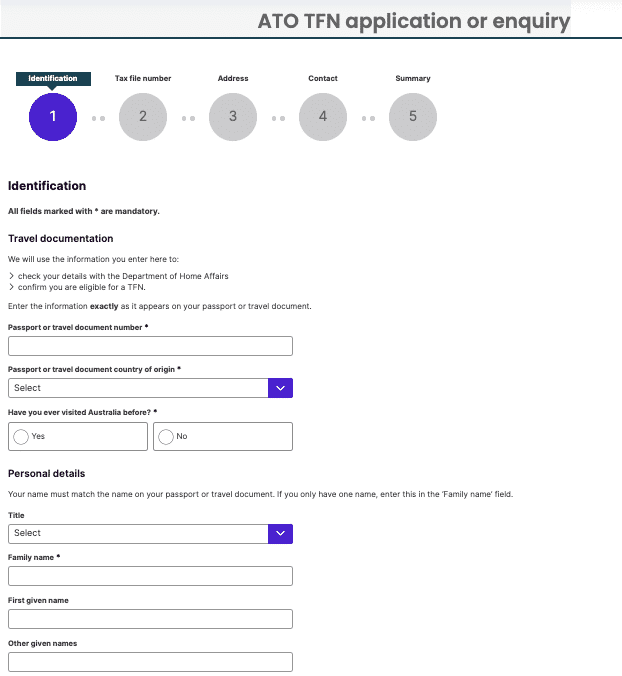

Personal Details

On the next page, you need to enter your identity details and personal information.

The fields marked with an asterisk* must be filled in.

You must enter your passport number, country of issue and indicate if you’ve ever been in Australia before (holiday, studies, work etc).

Then you need to provide your personal details: your title (Sir, Madam, Miss), your last name and your first name.

You will be asked if you have been known by any other names before (e.g. maiden name if you took your husbands name after marriage). Click no if this is not the case. You must then indicate your date of birth, specify your sex (male/female).

When all fields are completed, click Next.

Existing TFN or ABN

This page inquires about any former TFN or Australian Business Number (ABN) you may have had.

The first question asked on this page is “Have you ever applied for a TFN or ABN in Australia?“. You may have applied for an ABN or TFN a few years ago and even gotten one, but you do not remember it. In this case, we advise you to contact the ATO before applying online.

The second question is whether you have already obtained a TFN or ABN in Australia. Answer yes if this is the case. Then complete the following boxes with your TFN or ABN number.

You are then asked if you have ever filed a tax return in Australia. Usually the answer will be NO.

The last question asks you to indicate whether you own property or other earnings in Australia (e.g. dividends). Usually the answer will be NO.

Once this section is complete, click next.

Postal Address in Australia

You must then enter the postal address to which your TFN number will be sent. It is important to provide an address where you will reside for a minimum of 28 days (the maximum time it can take for your TFN to be posted to you). If you don’t have a long-term address, you can put down the address of your hostel or other accommodation. Don’t worry too much – if you’re no longer at the same address when your TFN arrives, you can get your TFN number by calling the ATO or dropping by one of their offices.

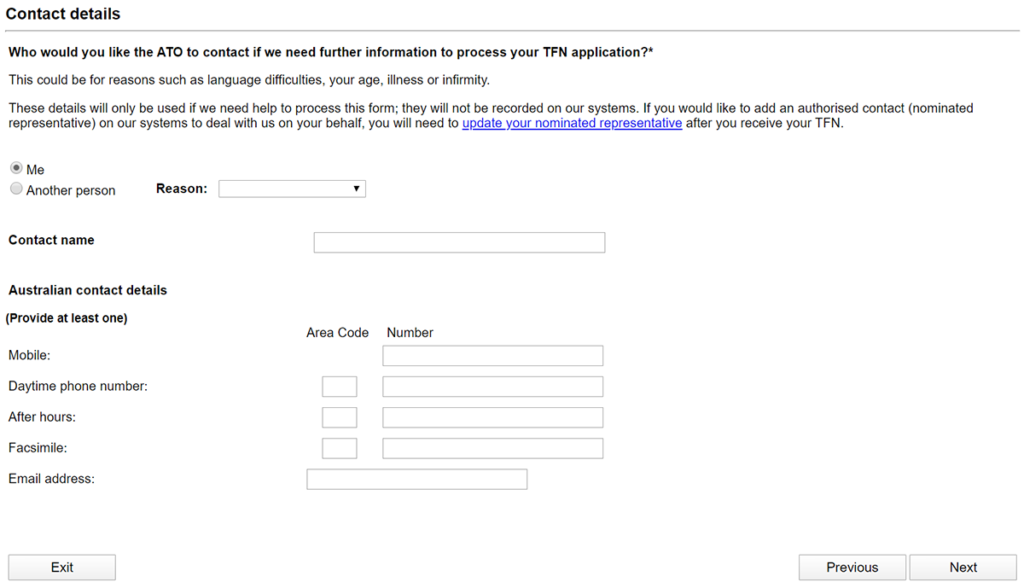

Personal Contact Details

Enter your Australian landline or mobile phone number and email address here.

Summary and Validation

The last step is to confirm that the information you have provided is correct.

If so, click the “SUBMIT” button.

Make sure you save your transaction number (Application Reference Number). Once you have clicked on “SUBMIT”, you will be redirected to a screen which confirms that your request has been registered.

Receive Your TFN

After submitting your application, you’ll get a reference number that you can use while waiting for your official TFN. The physical TFN will arrive by mail within 28 days at your registered postal address.

⚠ Moved? Lost your TFN?

No worries! Call 13 28 61 (Monday–Friday, 8 AM to 6 PM) for assistance. If you need language support, call the ATO translation service at 13 14 50.

TFN & Your First Job in Australia: What You Need to Know

General Information

A Tax File Number (TFN) is a unique identification number that every worker in Australia needs. If you’re on a Working Holiday Visa (WHV), you must have a TFN to ensure you’re taxed correctly.

📌 How does tax work?

- WHV holders are taxed at 15% on earnings up to $45,000

- If you earn between $45,001 – $135,000, higher tax brackets apply ($6,750 plus 30c for each $1 over $45,000)

- The highest tax rate is 45% for earnings over $190,001.

📌 Important: Your employer must be registered with the Australian Taxation Office (ATO) as a Working Holiday Visa employer. Otherwise, they must tax you at 32.5% instead of 15%!

Getting Your TFN for Your First Job

After submitting your TFN application, you should receive it within a maximum of 28 days (by mail). If this is not the case, directly contact the ATO by phone to obtain it, especially if you need to start working quickly. Normally, your employer should ask you to provide it before you begin your employment.

Before starting your first job, make sure to:

✅ Apply for your TFN (you can work while waiting for it)

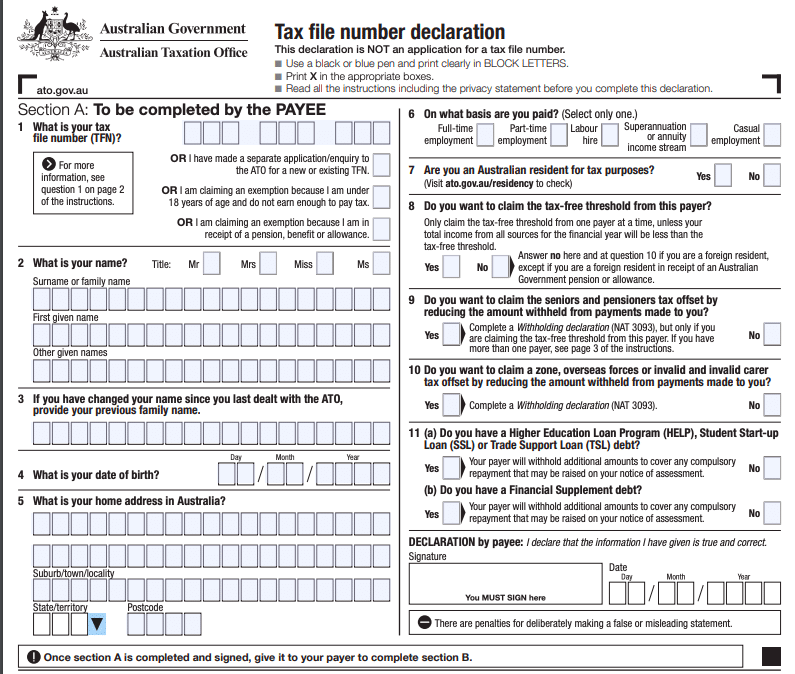

✅ Fill out a TFN declaration form (your employer will provide it)

✅ Ensure your employer is ATO-registered to get the correct tax rate

TFN and Tax File Number Declaration

The TFN is the unique and personal 9-digit number that register you with the Australian Tax Office (ATO). It is essential if you want to work in Australia (regardless of your visa).

On the other hand you will often hear about the TFN Declaration… which can be confusing. This declaration is indeed a form that you complete when you start a new job with an employer. Information you provide in this form will allow your employer (payer) to work out how much tax to withhold from payments made to you. This is not a TFN application (to apply you need to follow the steps describe in this article).

You should complete this form before you start to receive payments from a new payer.

FAQs

What if I don’t have an address in Australia?

Please note that it is important to provide an address where you will reside for a minimum of 28 days (maximum deadline for sending your TFN). If you don’t have long-term accommodation, you can use the address of a friend, your hostel or even a PO box.

What should I do once I have received my TFN number?

If you have already found a job, give your TFN number to your employer and they will update your file.

Your TFN number must also be forwarded to your Australian bank.

What should I do if I haven’t received my mail after 28 days?

Telephone the ATO on 13 28 61 to explain your situation, and your number will be communicated to you directly if it has already been assigned to you. The important thing is to get your TFN number, whether it is by letter or by phone.

I am renewing my WHV for a second year, do I have to re-apply for a TFN?

No. Your TFN is assigned to you for life, so you will never need to reapply.

My personal situation has changed, what should I do?

If you have a TFN but your personal circumstances have changed, you can notify the ATO by updating your MyGov account which is linked to the ATO. It is also possible to update your information by calling 13 28 61.

I have lost my TFN, what should I do?

If you have a TFN and cannot find it, you can log into your MyGov account.

If you don’t have a myGov account, you can usually find your TFN on:

- your income tax notice, if you have already filed a tax return

- the letters you received from the ATO

- a summary of payments (‘payment summary’, provided by your employer)

- your superannuation account statement.

If you still cannot find your TFN after checking these options, call the ATO on 132861

Can foreign residents obtain a TFN?

Yes, foreign residents can obtain a TFN if they need a tax identification number to work or for other financial reasons in Australia. If you are on a Working Holiday Visa and you want to work in Australia, you will need a TFN, it is mandatory.

When do I have to provide my TFN?

You must provide your TFN to your employer when you start working in Australia. You must also provide your TFN when you open a bank account, when you apply for a loan, and for any other important financial transaction.

Can I use the same TFN for different jobs?

Yes, you always use the same TFN for different jobs. It is a personal number that will serve you throughout your stay in Australia. It is important not to share your TFN with other people or organisations as this can put your identity and tax information at risk.

Writing a resume in Australia

All the information you need to create a good Australian resume + free samples to guide you