In the digital age, transferring money across borders has become a routine necessity for many, from expatriates sending remittances home to businesses managing international transactions. If you need to transfer money abroad but want to avoid paying high fees with your bank, we recommend you use a platform specifically designed for international transfers. CurrencyFair, a prominent player in the realm of online money transfers, offers a unique and cost-effective solution for these needs. This article delves into how CurrencyFair operates and provides an overview of user reviews to help you understand its value proposition.

Table of Contents

Benefit from 5 Free Transfers

Thanks to our partnership, we can offer 5 free transfers to our readers. To benefit from this, just click on one of the buttons on this page and create an online account. Once completed, you will see this credit of 5 free transfers in your profile. Log in to your account, go to the top right on your name, then select “my profile”.

How does it work?

One might think that the money is going directly to another country, but in reality, the money will pass through a local CurrencyFair account, thus limiting fees. Once your money is transferred to your CurrencyFair account, you will be able to exchange your currencies instantly at a much more attractive rate than those charged by banks. Once your currencies are converted, you can transfer to your bank account abroad (or vice versa).

Key Features

- Competitive Exchange Rates

- Low Fees: CurrencyFair charges a small, transparent transaction fee, plus a marginal rate on the exchange itself, which can result in considerable savings.

- Global Reach: CurrencyFair supports currency exchanges in over 20 currencies, catering to a wide range of countries and regions.

- Safety and Security: The platform uses advanced security measures to protect users’ funds and personal information, ensuring a safe transaction environment.

How much does it cost?

In terms of fees, CurrencyFair uses a flat fee of $4 per transfer, which is better than the competition that either uses higher fees or percentages on the amount transferred. Thus, by going through CurrencyFair, you pay 4 AUD, regardless of the amount transferred.

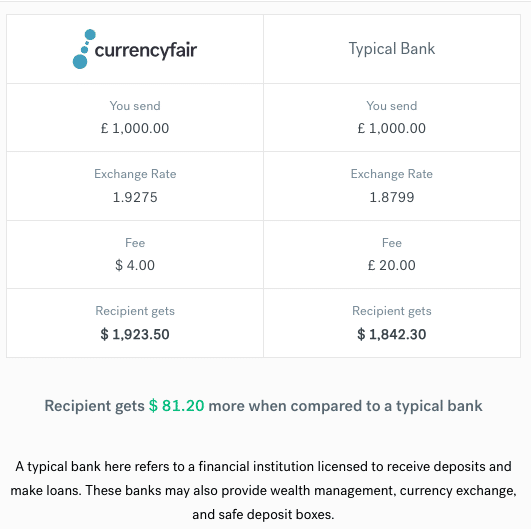

Comparison between CurrencyFair and a Bank

For a transfer of 1000£ (February 2024)

| Using a Bank | Using CurrencyFair | |

|---|---|---|

| Fixed Fees | £ 20- 25 (sometimes free) | AUD 4 (5 free transfers using our link) |

| Market Rate | 1 GBP = 1.9371739 AUD | 1 GBP = 1.9371739 AUD |

| Applied Rate | 1 GBP = 1.8799 AUD | 1 GBP = 1.9273 AUD |

| Recipient gets | AUD 1 842.30 | AUD 1,923.50 |

That’s a difference of almost AUD 85! The advantage of using such a service is all the more obvious when the rate is higher.

CurrencyFair features

CurrencyFair offers two types of accounts: a Personal Account and a Business Account.

Personal Account

1. International Transfer

CurrencyFair’s main feature for individuals.

You can make an instant transfer by bank transfer. You will need to create a free account on CurrencyFair website. Once done, you design the amount to be exchanged, the desired currency and you exchange it. Once you have added CurrencyFair’s bank details to your bank account (adding a beneficiary), the transfer takes 1-2 days. In practice, CurrencyFair will receive the money, exchange your currencies and then transfer the money to your account. It is the most used and fastest tool for a money transfer.

2. CurrencyFair Wallet (multi-currency account)

This option allows you to create your free multi-currency wallet. This way, your funds are always ready to be exchanged, in the currency of your choice. You top up anytime and transfer when you’re ready. This feature is very useful if you need to make transfers in multiple currencies, or if you simply have several accounts in different countries and/or currencies.

3. Exchange rate alert

CurrencyFair also offers an exchange rate alert feature. Just set up your alerts in your account and CurrencyFair sends you a notification when the rate is up, down or hits a certain threshold. Perfect if you want to follow the evolution of the rate of a currency and take advantage of the most favorable exchange rate for your transfer (especially if it involves large amounts).

Business Account

CurrencyFair has also developed a solution for professionals. For companies operating internationally, fluctuating exchange rates can quickly become a headache and a source of risk. To make their daily life easier, CurrencyFair therefore offers a business account to manage financial transactions abroad more easily.

The business account allows you to facilitate money transfers abroad, to make international payments (transmitters or receivers), while always guaranteeing advantageous exchange rates. It also offers multi-user access, an accounting tool for small businesses, a two-person approval function… all aimed at minimizing the risks associated with overseas operations.

CurrencyFair: About the company

CurrencyFair is a company established in 2009, headquartered in Ireland. It also has offices in the Singapore, Australia and Hong Kong.

The company is recognized as a payment institution by the Central Bank of Ireland under the regulation of the European Commission. It is also regulated by the Australian Safety and Investment Commission. CurrencyFair has all the necessary accreditations to make money transfers safely and wherever you are. It currently offers transfers in 20 different currencies and across more than 150 countries worldwide.

The web user interface is very complete and offers many features. A mobile app is also available for Android and iOS.

With CurrencyFair, there are no nasty surprises. You know the exchange rate applied, the fees charged and know exactly how much you will receive on your account. You only have one $4 commission applied on the amount transferred.

Our experience with CurrencyFair

The reviews of the user interface of CurrencyFair is almost perfect. In addition to being ergonomic, it is a full management application.

As for the other platforms, to make your first bank transfer, there are three parameters to take into account for the time needed:

- The time imposed by your bank to add a beneficiary to your transfers. This can take between 24 and 72 hours depending on the bank.

- The time required for your bank to make your transfer. For example, if you make the transfer on the weekend you will have to wait until Monday.

- The time it takes CurrencyFair to transfer the money to your other account.

Our first Bank transfer took us 5 days starting with registering on a Monday, the money was on our Australian account on the Friday of the same week.

Personally, we always use the bank transfer. We simply tested the transfer via Market Place. We found it quite entertaining to be able to set our rate by doing a “call for tenders”. But we believe that this system is more suitable for people who want to act like they’re on Wall Street and make profits.

Important note

To be authorized to carry out transfers of more than 1000 EUR, you have to verify your identity. You will need an ID and 2 certificates of residence. Therefore, we strongly recommend that you enter the address of your country of origin when registering for consistency and to simplify the verification process.

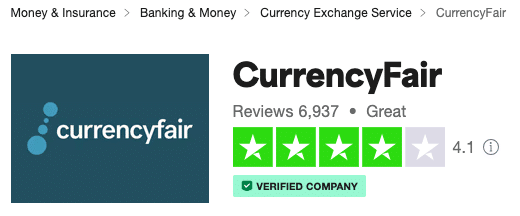

CurrencyFair Reviews & Comments

Positive Feedback:

- Cost Savings: Many users praise CurrencyFair for its low fees and favorable exchange rates, highlighting significant savings compared to banks and other transfer services.

- User-Friendly Platform: Customers often commend the ease of use of both the CurrencyFair website and mobile app, noting that the process of sending money is straightforward and hassle-free.

- Customer Support: Reviews frequently mention responsive and helpful customer service, which enhances the overall user experience.

Areas for Improvement:

- Availability of Currencies: While CurrencyFair offers a broad selection of currencies, some users have noted the absence of certain currencies, limiting their ability to use the service for all their transfer needs.

- Transfer Speed: Although transfers are generally efficient, the speed can vary depending on the currency pair. Some users have expressed a desire for faster transfers.

Why do we recommend CurrencyFair?

CurrencyFair has been a reliable, secure and internationally recognized service for more than ten years. CurrencyFair is above all the fast and safe way to send money abroad, while enjoying advantageous rates.

Traveling to the other side of the world already involves enough preparation and questions. Let’s not add the stress of financial risks. So don’t worry about your money, CurrencyFair takes care of everything and in no time, your money will be available in your account in your new currency. Finally, in case of doubt or delay, know that CurrencyFair offers a super efficient customer service, in several languages.

FAQs

A query? Contact CurrencyFair via email: theteam@currencyfair.com or through their contact page.

Related Articles:

Thanks a ton for sharing the info and I sincerely hope I get 5 free transfers. I’ve been planning to shift to currency fair. But if it’s possible to get 5 free transfers then I guess I made a decision.

I’ll again write a comment about my experience after 2 weeks.

Thanks

Thanks for your feedback Samantha 🙂